Asset Turnover Ratio Increase Means

Each of the current assets will. Divide each years sales by its total assets to calculate each years asset turnover ratio.

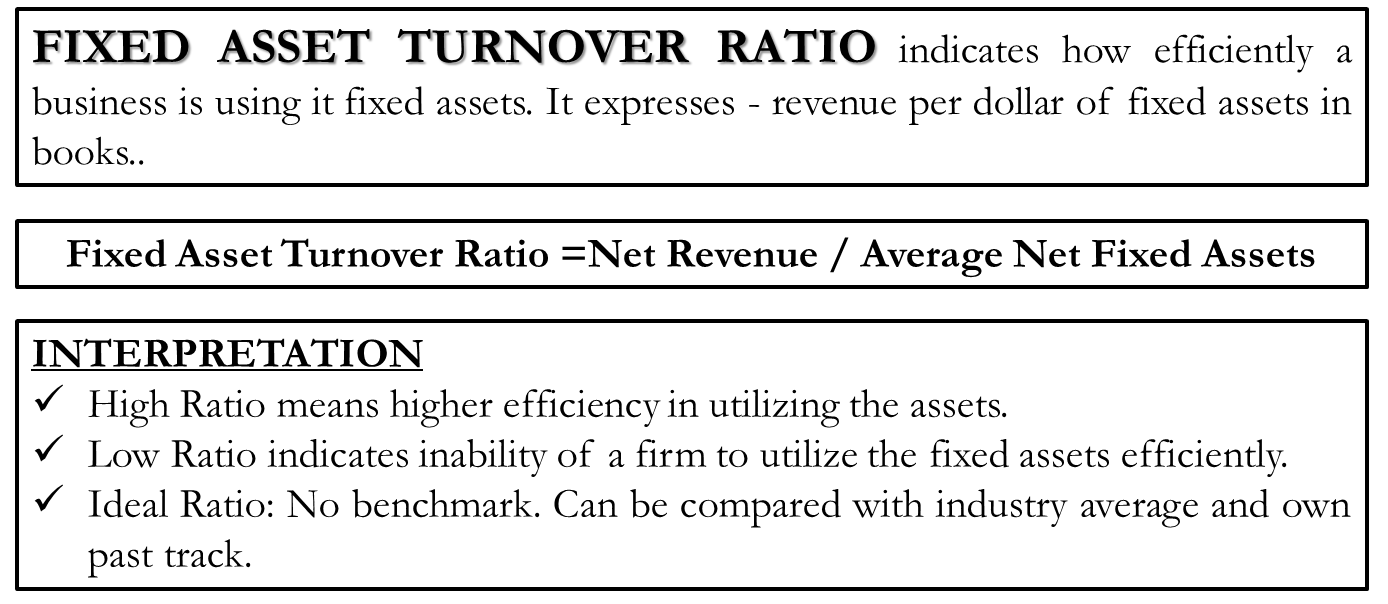

Fixed Asset Turnover Definition Formula Interpretation Analysis

Company X has a.

. In general the stock turnover ratio tells us about the efficiency of the business. In this example divide 18 billion by 750 million to get an asset turnover ratio of 24 in the most. A high asset-to-turnover ratio is important for several reasons.

Interpretation of the two ratios. The higher asset turnover ratio means the. For example if a company has 65 Assets Turnover Ratio.

Current Asset Turnover Year 2 3854 766 503. The calculation is as follows. The ratio compares the companys gross.

This means that Company As. Year 2 witnessed a slight decrease of firms current asset turnover ratio from 510 to 503 comparing to year 1. The asset turnover ratio is a measurement that shows how efficiently a company is using its owned resources to generate revenue or sales.

If the ratio is higher it signifies better performance and vice versa. The inventory turnover ratio also known as the stock turnover ratio is an efficiency ratio that measures how efficiently inventory is managed. Which means each dollar of assets are generating 065 cents of sales.

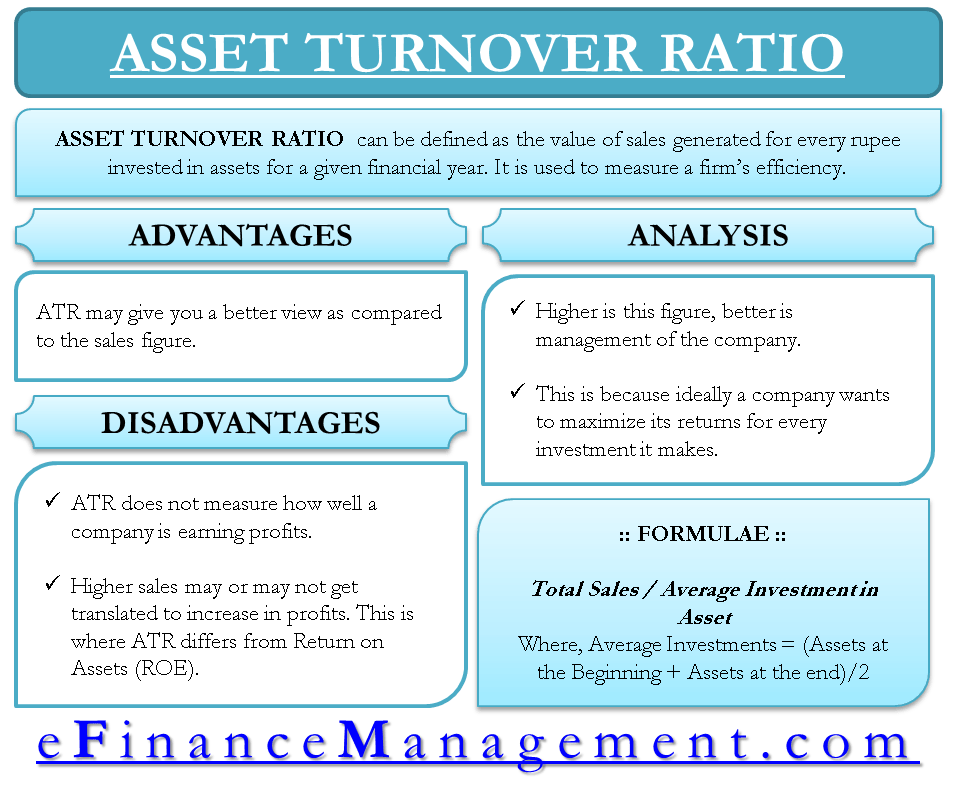

But while calculating the asset turnover we observe that company Y has a lower ratio than company X with a difference of 004. Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets. Asset Turnover Ratio Net Sales Average Total Assets Net Sales is the revenue after deducting sales returns discounts and allowances.

The Asset Turnover ratio can often be used as an. What Does Total Asset Turnover Ratio Mean. When the company has a higher.

This efficiency ratio compares net sales income statement to fixed. The Asset Turnover Ratio is a metric that measures the efficiency at which a company utilizes its asset base to generate sales. Unlike other turnover ratios like the inventory turnover ratio the asset turnover ratio does not calculate how many times assets are sold.

Net sales Total assets. The ratio is calculated by dividing a companys net sales for a specific period by the average total assets the company held over the same period. First it indicates that a company is able to maintain and grow its assets over.

Average total assets are calculated. You can use the asset turnover rate formula to find out how efficiently theyre able to generate revenue from assets. Average inventory is the.

Total Sales Annual sales total. This indicates a slight. Beginning Assets Assets at start of year.

The fixed asset turnover ratio FAT is in general used by analysts to measure operating performance. The asset turnover ratio is calculated by dividing net sales by average total assets. The importance of a high asset-to-turnover ratio.

The asset turnover ratio can be. The formula for total asset turnover can be derived from information on an entitys income statement and balance sheet. 500000 2000000 025 x 100 25.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

No comments for "Asset Turnover Ratio Increase Means"

Post a Comment